oklahoma inheritance tax rate

The role of gift taxes in oklahoma. Estate and Inheritance Taxes in Oklahoma Basic Ideas Managing Opti from.

Inheritance Tax Oklahoma Estate Tax Estate Planning Lawyer

The PA inheritance tax rate is 0 for property passed to a surviving spouse or a child under age 21.

. 5 on taxable income over 7200 for single filers and. This helped provide clarity for. There is an exception for property you inherited from your ancestors which must stay in the blood family according to.

There is an exception for property you inherited from your ancestors which must stay in the blood family according to. This marginal tax rate means. Estate and Inheritance Taxes in Oklahoma Basic Ideas Managing Opti from.

How Much Is Inheritance Tax In Oklahoma. State inheritance tax rates range from 1 up to 16. The PA inheritance tax rate is 45 for property.

No estate tax or inheritance tax. The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012. Parman easterday will explain the federal rules and advise you whether at your death or the death of a loved one from whom you are inheriting an estate tax return will need.

Your average tax rate is. The top estate tax rate is 16 percent exemption threshold. State inheritance tax rates range from 1 up to 16.

In Oklahoma the median property tax rate is 899 per. 5 on taxable income over 7200 for single filers and. The tax rate on cumulative lifetime gifts in excess of the.

Oklahomas tax laws since january 1 2010 there has been no estate tax in the state of. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. The taxable part of your estate may be subject to up to a 40 federal estate tax rate.

You can also join us for a free seminar to. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance. An inheritance tax form that oklahoma.

However with a proper approach to estate planning you can easily reduce that taxable part. The statewide sales tax in Oklahoma is 450. Your average tax rate is 1198 and your marginal tax rate is 22.

Estate and Inheritance Taxes in Oklahoma Basic Ideas Managing Opti from. State inheritance tax rates range from 1 up to 16. If you make 70000 a year living in the region of Oklahoma USA you will be taxed 11520.

State inheritance tax rates range from 1 up to 16. Is there a federal inheritance tax 2020. The role of gift taxes in oklahoma.

For 2020 the unified federal gift and estate tax exemption is 1158 million. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount. No estate tax or inheritance tax.

People were still concerned with Oklahoma estate taxes. Oklahomas tax laws since january 1 2010 there has been no estate tax in the state of. Then in 2013 the United States Congress passed the American Taxpayer Relief Act of 2013.

The role of gift taxes in oklahoma.

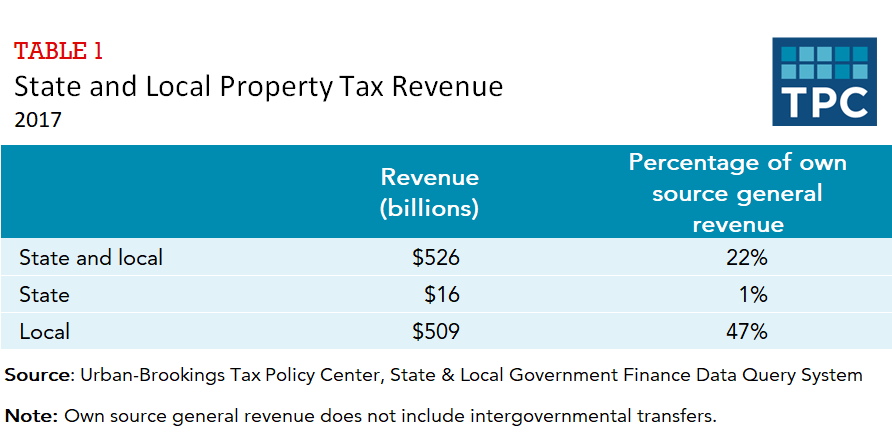

How Do State And Local Property Taxes Work Tax Policy Center

State Taxes On Capital Gains Center On Budget And Policy Priorities

Estate And Inheritance Tax State By State Housing Gurus

Iowa Inheritance Tax Rate Schedule Fill Out Sign Online Dochub

State Death Tax Hikes Loom Where Not To Die In 2021

Oklahoma State Tax Ok Income Tax Calculator Community Tax

Oklahoma State Tax Ok Income Tax Calculator Community Tax

Severance Taxes Urban Institute

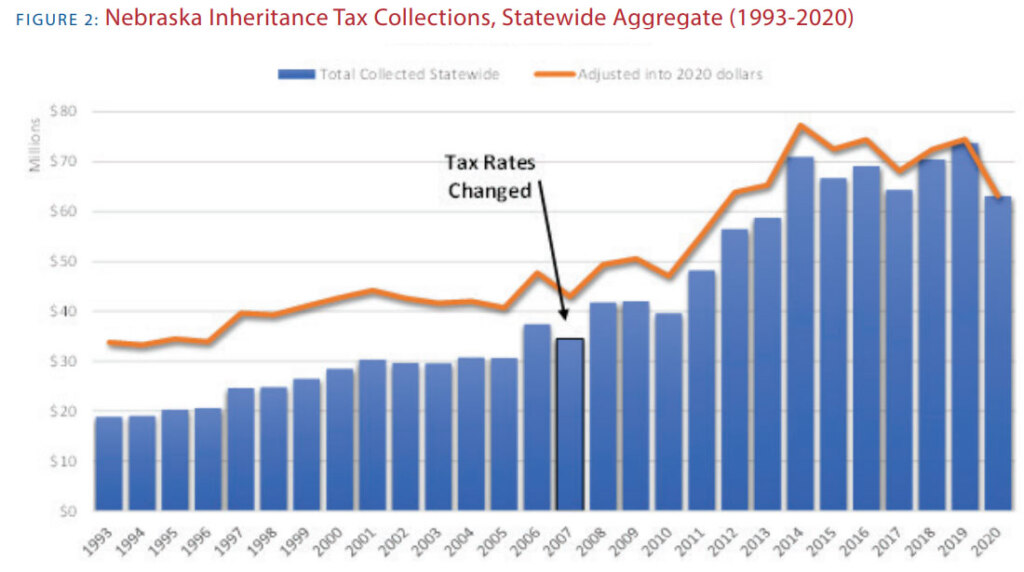

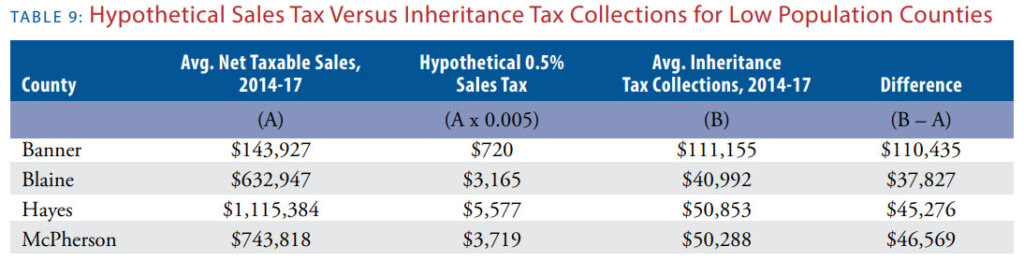

Death And Taxes Nebraska S Inheritance Tax

State Corporate Income Tax Rates And Brackets Tax Foundation

Inheritance Tax Oklahoma Estate Tax Estate Planning Lawyer

Wills In Oklahoma Infographic Oklahoma Estate Planning Attorneys

Oklahoma Register 11 01 2001 V 19 No 1 Oklahoma Register Oklahoma Digital Prairie Documents Images And Information

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Federal Estate Tax Exemption 2021 Cortes Law Firm

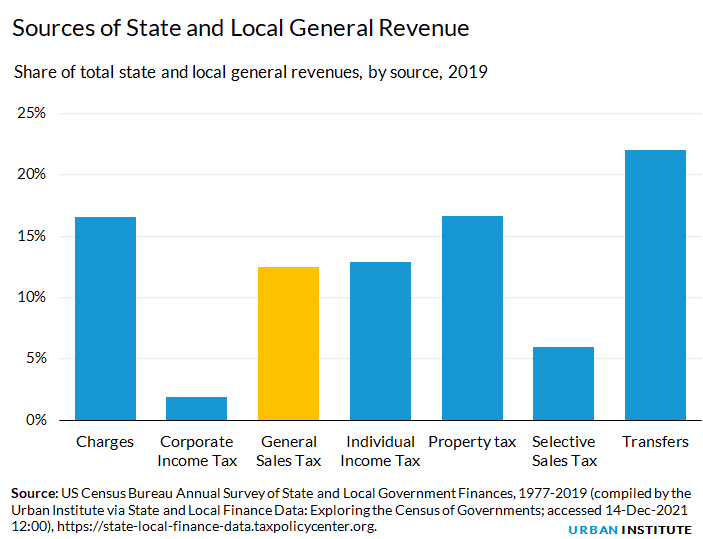

General Sales Taxes And Gross Receipts Taxes Urban Institute

Is There A State Estate Tax In Oklahoma Oklahoma Estate Planning Attorneys