irs income tax rates 2022

And for heads of households the standard deduction will be. IR-2022-150 August 15 2022 WASHINGTON The Internal Revenue Service today announced that interest rates will increase for the calendar quarter beginning October 1 2022.

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

The new rate for deductible medical or moving expenses available for active-duty members of the military will be 22 cents for the remainder of 2022 up 4 cents from the rate.

/images/2022/01/18/individual-tax-rates-by-state.png)

. Your bracket depends on your taxable income and filing status. It is increasing by 900 to 13850 for single taxpayers and by 1800 for married couples to 27700. 2022 tax brackets for individuals.

Single filers may claim 13850 an increase. Federal Income Tax Brackets 2022. Social security tax 62 income below a threshold Medicare tax 145 income below a threshold Additional Meducare tax 09 income exceeding a threshold What is.

The standard deduction will also increase in 2023 rising to 27700 for married couples filing jointly up from 25900 in 2022. Here are the 2022 tax rates and brackets organized by filing status. The 2023 standard deduction for couples married filing jointly is 27700 up 1800 from 25900 in tax year 2022.

Each of the tax brackets income ranges jumped about 7 from last years numbers. Explore updated credits deductions and exemptions including the standard deduction. The IRS is boosting tax brackets by about 7 for each type of tax filer such as those filing separately or as married couples.

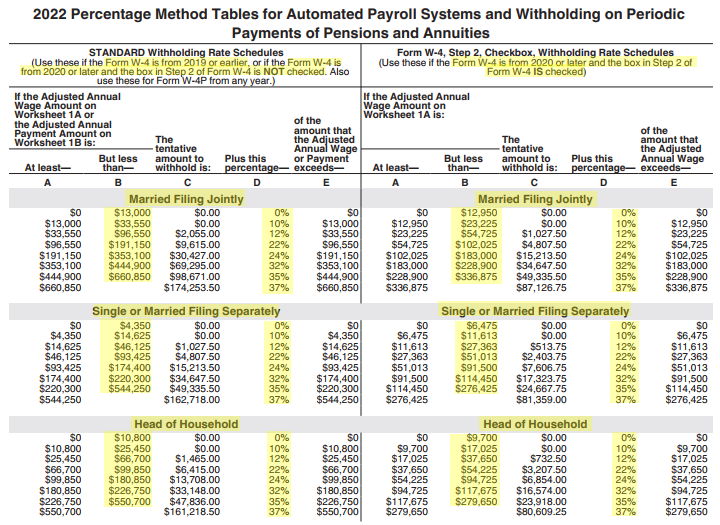

Federal income tax rate table for the 2022 - 2023 filing season has seven income tax brackets with IRS tax rates of 10 12 22 24 32 35 and 37 for Single Married. For tax year 2023 the top tax rate remains 37 for individual single taxpayers with incomes greater than 578125 693750 for married couples filing. The IRS recently released the new inflation adjusted 2022 tax brackets and rates.

For heads of household the 2023 standard deduction will be 20800. For those filing head of household the standard. For married couples filing jointly the new standard deduction for 2023 will be 27700.

The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up. The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. The seven tax rates remain unchanged while the income limits have been.

The IRS tax tables MUST be used. There are seven federal tax brackets for the 2022 tax year. The Internal Revenue Service IRS has released 2023 inflation adjustments for federal income tax brackets the standard deduction and other parts of the tax code.

These are the rates for. 10 12 22 24 32 35 and 37. Also the standard deduction will increase in 2023 by 900 to 13850 for single filer or married but filing separately by 1400 to 20800 for head of households and 1800 to.

This is a jump of 1800 from the 2022 standard deduction. Heres a breakdown of last years income. The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday.

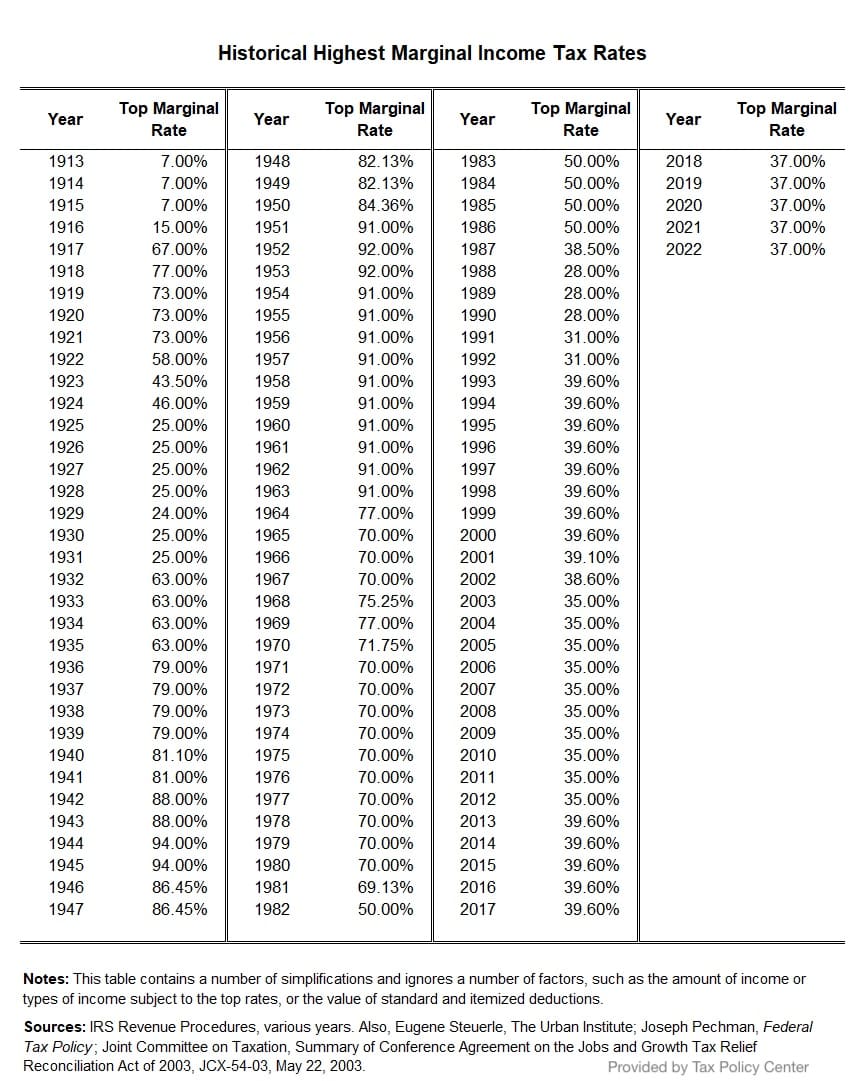

The standard deduction for married couples filing jointly for tax is increasing by 1800 from last year to 27700. Using the 2022 regular income tax rate schedule above for a single person Joes federal income tax is 5187. The top marginal rate or the highest tax rate.

43500 X 22 9570 - 4383 5187. Fringe benefits aircraft valuation formula. 37 for incomes over 539900 647850 for married couples filing jointly 35 for incomes over 215950 431900 for.

Tax brackets for income earned in 2022. For purposes of section 161-21g of the Income Tax Regulations relating to the rule for valuing non-commercial flights on employer-provided. 10 of taxable income.

/images/2022/01/18/individual-tax-rates-by-state.png)

Here Are The States Where Tax Filers Are Paying The Highest Percentage Of Their Income Financebuzz

Really My Bonus Is Taxed The Same As My Paycheck Human Investing

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

2021 Form 1040 Tax Table 1040tt

2022 2023 Tax Brackets Rates For Each Income Level

Federal Personal Income Tax Rates Schedule 1 Haefele Flanagan

Understanding Marginal Income Tax Brackets Gentz Financial Services

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Internal Revenue Service

Irs Tax Brackets 2022 What Do You Need To Know About Tax Brackets And Standard Deduction To Change In 2022 Marca

2022 Tax Brackets Prestige Wealth Management Group Wealth Management In New Jersey

Are Federal Taxes Progressive Tax Policy Center

State Corporate Income Tax Rates And Brackets Tax Foundation

2022 2023 Tax Brackets Standard Deduction Capital Gains Etc

Powerchurch Software Church Management Software For Today S Growing Churches

What Is My Tax Bracket 2022 2023 Federal Tax Brackets Forbes Advisor

Income Tax History Tax Code And Definitions United States